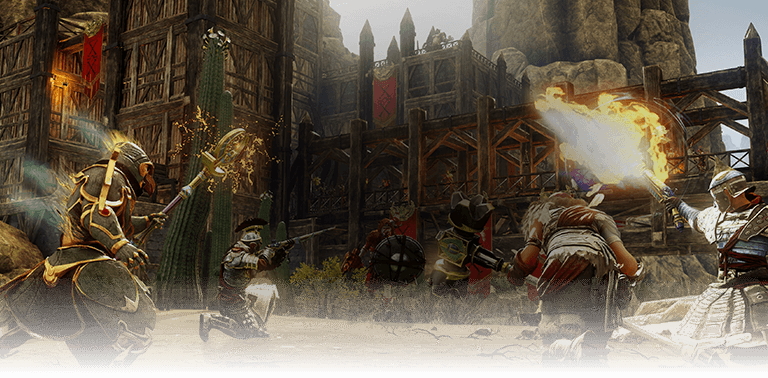

New World values, emphasizes, and celebrates player interaction and community.

You can chat with players in Aeternum through text and voice, but we want to connect you with other players, and with our team, outside of the game—find us on social or get involved via our Creator Program.